newport news property tax exemption

Click here to download an application. Council Tax APPLICATION FOR DWELLING EXEMPTION THE PROPERTY IS EMPTY AND UNOCCUPIED THE PROPERTY IS OCCUPIED BUT CERTAIN CONDITIONS APPLY PLEASE READ THE DECLARATION AND SIGN BELOW Address Name of Person or Company Holding the Freehold or Relevant Leasehold Interest in the Property ie the Owner or Tenant Address for.

City Of Newport Tax Assessor S Office

The Newport News City Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes.

. Newport News VA 23607. Regular Irregular Polygons Worksheet. Revocation Of Separation Agreement.

Ssa No Match. At other times normal council tax is due subject to any other reductions that may apply. California Consent To Enter Judgment For Possession.

BOYLE Commissioner of the Revenue FOR OFFICE USE ONLY 1. Last year a microchip shortage slowed the production of new vehicles which in turn increased demand for used cars and trucks. The City of Newport News makes no representation as to affect the deferral of real property tax payments may have under any Deed of Trust or Promissory Note.

401 845-5300 M-F 830 am - 430 pm Fax. Residential Rehabilitation Property Tax Abatement. Divorce Decree Public Record Edwardsville Il.

43 Broadway Newport RI 02840 Phone. If you are in the Armed Services not a resident of Virginia and are a full time active duty military member you may be exempt from the personal property tax and vehicle license fee based on your military status. REAL ESTATE TAX EXEMPTION FOR THE ELDERLY City of Newport News Virginia Phone.

For qualifying vehicles valued at 1000 or less your obligation to pay this tax has been eliminated for tax years 2006 and forward. Refer to Car Tax Relief qualifications. School Rules And Regulations Questionnaire.

One section says the Newport City Council is authorized to annually fix the amount if any of a homestead exemption with respect to assessed value from local taxation on taxable real property used for residential purposes The amount cannot exceed a 35 percent exemption for single-family homes and condominiums the provision says. The General Assembly hereby exempts from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. Any exemptions awarded are calculated on a daily basis for the period when the particular circumstances apply.

OTHER PERSONS LIVING AT THE ABOVE ADDRESS. For properties considered the primary residence of the taxpayer a homestead exemption may exist. Bonneville County Property Tax Rate.

If you are elderly andor disabled and living in a mobile home you may qualify for a tax break. Personal Property Tax Relief Act The tax on the first 20000 of the assessed value of your qualified personal property will be reduced for tax years 2006 and forward. Newport homeowners who served in the military during the Cold War period from 1947 until 1991 are now eligible to qualify for property tax relief through the Rhode Island Veterans Exemption.

Learn all about Newport real estate tax. If you have a specific question regarding personal property tax please consult our Personal Property FAQ or call the Treasurers Office at 757-926-8731. Watch Satisfaction Usa Online Free.

Whether you are already a resident or just considering moving to Newport News City to live or invest in real estate estimate local property tax rates and learn how real estate tax works. This provision passed by the General Assembly earlier this year also includes the widowwidower of a veteran who served during the Cold War. NEWPORT City homeowners who served in the military during the Cold War period from 1947 until 1991 are now eligible to qualify for property tax relief through the Rhode Island Veterans Exemption.

However if you do not plan to apply for Real Estate Tax Exemption you must separately apply for the Solid Waste Relief by contacting the City of Newport News Call Center at 757-933-2311. Whether you are already a resident or just considering moving to Newport to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Apply - exemption for emptyunoccupied property.

Wwwnnvagovcor Applications Accepted through August 31 2022 TIFFANY M. Therefore if you file for a Real Estate Tax Exemption it will not be necessary for you to take any action or file a separate application for the Solid Waste Fee Grant Relief Program. Some dwellings may be exempt from council tax.

APPLICANT INFORMATION PLEASE PRINT CLEARLY 2. The Newport News City Council voted to switch from a tax exemption program to a deferral last year which means that instead of being exempt from property taxes lower-income seniors can now defer. Applicants are encouraged to contact their mortgage lender prior to applying for the Citys Real Estate Tax Deferral program.

Residents of the City of Newport age 65 and older who have lived in their homes for a minimum of five 5 years with income levels at or below. Mobile Home Tax Exemption. Newport News City Council voted to ease the property tax burden on city residents for the current calendar year.

Download the application today. Bc Physicians And Surgeons Complaints. Note- City code requires that all Deferred tax years andor the current fiscal year of Elderly Tax Exemption be reinstated if the property is being sold or there is a change in ownership.

Learn all about Newport News City real estate tax. When an automobile is licensed with out-of-state tags solely in the military members name a Newport News personal property return is not required. Learn about the Residential Rehabilitation Property Tax Abatement program including its benefits and an application.

757 926-3535 Web Site. Please contact the Real Estate Assessors Office 757 926-1926 for further instructions. The value of vehicles usually is expected to decline over time but the shortage has meant that the fair market values are higher than they.

Application for senior property tax exemption claim WHO IS ELIGIBLE. Department of Veterans Affairs to have a 100 service-connected permanent and total disability and who occupies the real property as his or her principal place of residence. All groups and messages.

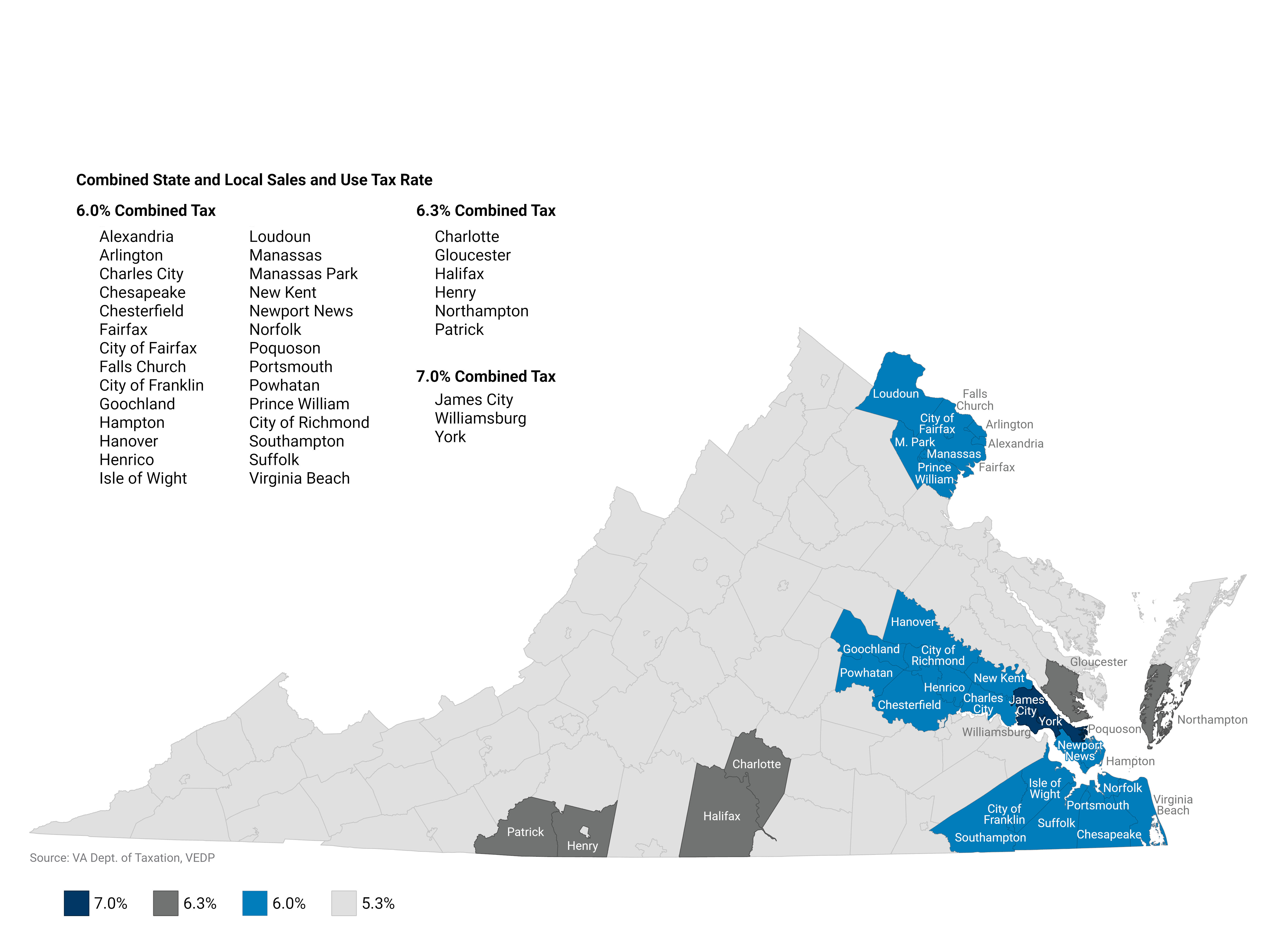

How Does Virginia Beach Compare To Other Hampton Roads Cities Vbgov Com City Of Virginia Beach

Fill Free Fillable Forms City Of Newport News

Fill Free Fillable Forms City Of Newport News

Fill Free Fillable Forms City Of Newport News

Fill Free Fillable Forms City Of Newport News

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Taxes Mr Williamsburg Revolutionary Ideas On Real Estate Hampton Roads Virginia

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Commissioner Of The Revenue Newport News Va Official Website

Youth Challenge To Seek City Tax Exemption Funding Chicago Tribune

The Complete Guide To Garnishment Exemptions Law Merna Law

Newport News Commissioner Of The Revenue

Appeals Panel Some Home Tenants Can Qualify For Property Tax Exemption Pay Attention To This One Lawyers Say Cook County Record

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com